The 2025 PEA for i-80 Gold’s Cove Project highlights strong economic potential, refining mining models and hydrology for future feasibility studies.

|

| i-80 Gold updates its preliminary economic assessment for the Cove Project in Nevada, reporting an after-tax NPV of $271M and a 30% IRR at $2,175/oz gold. Image: i-80 Gold Corp |

Reno, Nevada, USA — February 22, 2025:

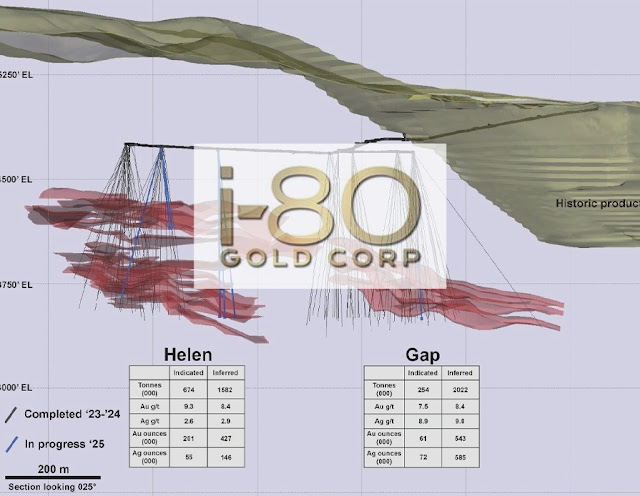

i-80 GOLD CORP. has released an updated preliminary economic assessment ("2025 PEA") for the Cove Project, an advanced underground exploration initiative in Northern Nevada’s Battle Mountain-Eureka Trend. The study confirms the project’s potential to play a crucial role in the company’s regional "hub-and-spoke" mining and processing strategy.

The 2025 PEA replaces the 2021 assessment and incorporates a remodeled deposit with a more confined mining geometry, an advanced hydrology model, and updated pricing, capital, and operating costs. The study highlights an after-tax net present value (NPV) of $271 million at a 5% discount rate and an internal rate of return (IRR) of 30% at a gold price of $2,175 per ounce.

“The 2025 PEA for the Cove Project represents an important first step in delivering updated technical information across i-80 Gold’s asset portfolio,” said Richard Young, CEO of i-80 Gold. “The results validate our planned regional hub-and-spoke model of feeding a central processing plant with high-grade material from three underground mines, which will form the production base for i-80 Gold moving forward.”

The company anticipates releasing further PEA updates for the Granite Creek and Ruby Hill Complex projects in the coming weeks.

Matthew Gili, President and COO of i-80 Gold, emphasized the significance of the study: “The Study highlights the value Cove brings to our gold portfolio, showcasing high-grade mineralization on a brownfield site in a top-tier mining jurisdiction, with low capital requirements and a high return on invested capital.”

The updated assessment integrates findings from hydrological studies, refining the project's dewatering needs. The completion of an exploration decline has also enabled infill resource drilling and metallurgical testing, which will contribute to a feasibility study expected in the fourth quarter of 2025.

The report also discusses "cash cost per gold ounce," a commonly used financial metric in the gold mining industry. While not standardized under IFRS or US GAAP, the measure is based on a standard developed by The Gold Institute, which remains an industry benchmark in North America.

With updated economic models and additional exploration data, i-80 Gold is poised to advance the Cove Project towards feasibility. The company remains focused on optimizing its regional operations to enhance efficiency and maximize shareholder value.

For further updates, investors and stakeholders can follow i-80 Gold’s upcoming announcements on its official channels.